Mandatory flood insurance purchase requirements and floodplain management standards apply.Īreas subject to inundation by 1-percent-annual-chance shallow flooding, typically areas of ponding, where average depths where average depths are between one and three feet. Mandatory flood insurance purchase requirements and floodplain management standards apply.Īreas subject to inundation by the 1-percent-annual-chance flood event determined by detailed methods. Because detailed hydraulic analyses have not been performed, no Base Flood Elevations (BFEs), or flood depths are shown. FEMA Flood ZonesĪreas subject to inundation by the 1-percent-annual-chance flood event generally determined using approximate methodologies.

Definitions for all FEMA flood zones are provided in the table below. These zones could still have flood risk as historically more than 20% of NFIP claims are made by policyholders in a X, B, or C zone. FEMA’s low and moderate risk flood zones – those outside the SFHA – are those that begin with the letters “X,” “B,” or “C.” Flood insurance is not required within these zones. The SFHA designation is important because it is the basis for floodplain management regulations for communities across the country and because it decides whether a home is required to have flood insurance or not.įEMA’s high-risk flood zones – those that make up the SFHA – are those that begin with the letters “A” or “V.” Homeowners located in A or V zones are required to purchase flood insurance if they have a mortgage from a federally-backed or federally-regulated lender. As a result, FEMA maps the areas with a 1% annual chance of flooding. In developing zone maps, FEMA focuses primarily on identifying the 1-percent annual chance floodplain (also known as the 100-year floodplain, Special Flood Hazard Area, or SFHA).

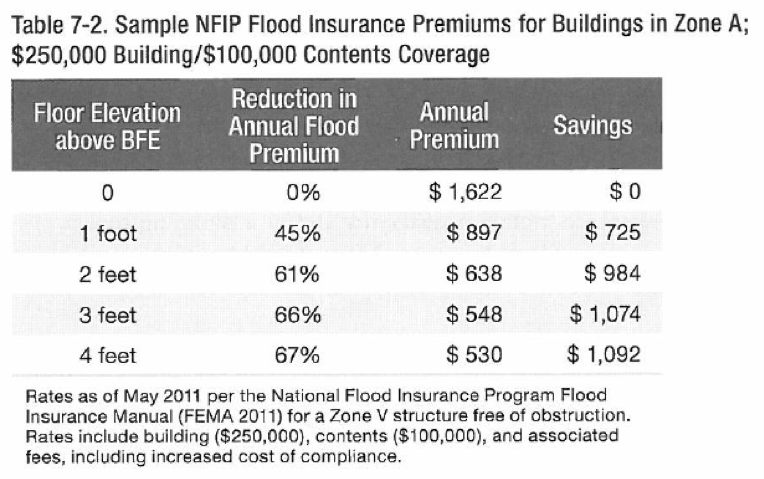

FEMA creates FIRMs to inform flood insurance pricing in the National Flood Insurance Program (NFIP) and to guide floodplain management regulations for NFIP-participating communities. In addition to saving money on your insurance, these steps can also help prevent damage and give you peace of mind.Learn about the definitions of FEMA Flood Zones and the differences between them.įederal Emergency Management Agency (FEMA) Flood MapsįEMA maps flood zones in communities across the US, identifying areas of varying flood risk on Flood Insurance Rate Maps (FIRMs). This can include installing hurricane shutters, grading your property so water moves away from your home and raising your HVAC unit above ground level. Your flood insurance company may give you a discount if you take steps to avoid flooding.

Fema flood insurance rates upgrade#

Keep in mind that you'll need to pay the deductible before your insurance kicks in. Having a higher deductible will lower the cost of your insurance, because your company won't have to pay as much if your home is damaged by a flood.

0 kommentar(er)

0 kommentar(er)